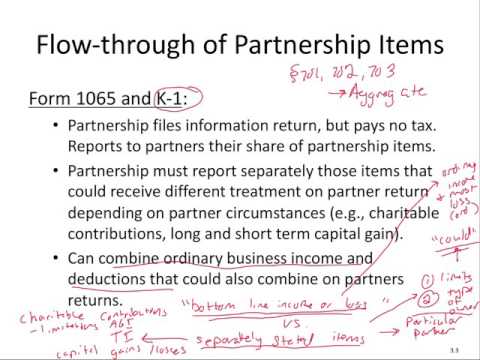

Hello, this topic considers tax issues related to partnership operations. So, before we dive into the respective issues, the first thing I want to talk about is the idea of subchapter K and the theory behind it. When Congress was considering how exactly to tax partnerships, there were two competing theories. Before we discuss the theories, it's important to remember that partnerships are taxed at a single level. The partnership itself is not taxed; however, it flows through the partnership to the actual owners. However, for various issues, it makes sense to consider the partnership as a taxable entity, just not paying tax on itself. These two theories are called the entity theory and the aggregate theory of taxation. The entity theory says that a partnership is a separate entity with respect to tax purposes. This means that it is separate from its owners, who each have various accounting methods and tax years. Under the entity theory, the partnership itself calculates its tax year on one single year for the partnership. Now, let's talk about the specific rules of how it calculates it, but there's only one tax year. We don't actually look at each respective partner and say, "Okay, well, you're going to flow through the items and determine in each part." That would be too difficult, especially if you have hundreds of partners. The accounting method is the same idea. Different partners could be corporations or individuals, and they could have a crude versus cash method of accounting, which creates another issue. So, we do one just based on the partnership itself. There are other things that the entity theory comes into play, such as elections. For example, in section 1033 involuntary conversion, which must be an election or installment sales, all of those must take place. Think about the issues you...

Award-winning PDF software

1065 due date 2025 Form: What You Should Know

Filing Form 1099-MISC, Miscellaneous Income, if not claimed on Form 1040. A return due date. April 15th of the 4th month after your tax year-end. If you have a limited period of use, for example, the first 4 months of your tax year you must file by April 15th. This date also matches the 30th day of the 4th month to be eligible for the credit if claimed. When Form 1099-MISC is filed, be sure to include the proper amount with Form 1040. IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1065, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1065 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1065 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1065 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1065 due date 2025